Fiscal year 2011 was a big year for the IRS whistleblower program according to the IRS Whistleblower Office’s Fiscal Year 2011 Report to the Congress on the Use of Section 7623. Some of the highlights from the report are:

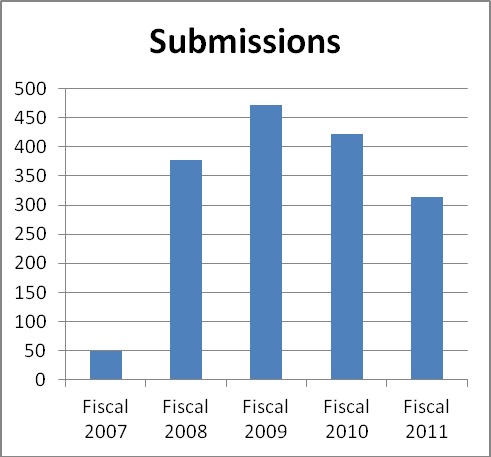

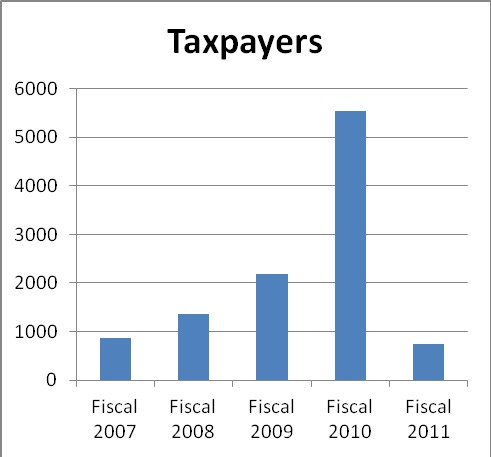

- The number of submissions in fiscal year 2011 dropped by approximately 25 percent from the number of submissions in fiscal year 2010 and the number of taxpayers reported in the submissions dropped by 87 percent for the same time period. See the charts below.

- The first awards were paid under section 7623(b).

- The IRS issued proposed regulations and sought comments on regulations to define the term “collected proceeds,” which were finalized on February 22, 1012.

- For the first time, the IRS included tables that detail the number of open claims that in are in each of the nine status designations; and the average time, the longest time, and shortest time that claims spend in each status.

Going Forward

The Fiscal Year 2011 Whistleblower Office Report indicates that the IRS whistleblower program also has significant changes planned in fiscal year 2012. According to the annual report, the IRS Office of Chief Counsel is working with the Assistant Secretary of Tax Policy, the Whistleblower Office, and other IRS offices on the drafting of comprehensive proposed regulations. These regulations are expected to revise the current regulations implementing section 7623 to reflect the remaining 2006 amendments to the statute. Also, the IRS Whistleblower Office is looking for ways to improve the administrative process for evaluating whistleblower contributions, and for communicating with the whistleblower about a proposed award determination based on its experiences with the initial cases that have proceeded through the award determination phase. The timeliness of subject matter review was also the subject of a field directive released on the same day, which is discussed here.

Recent Comments