The IRS Whistleblower Office has released its Annual Report to Congress for Fiscal Year 2013. We had a good year with the IRS Whistleblower Program because they paid one of our clients a $38 million award, but overall the report certainly shows that there is a lot of room for improvement. While fiscal year 2012 gave many whistleblowers a lot of hope for the program with its first big award payout, fiscal year 2013 was somewhat flat. Some of the highlights from the Fiscal Year 2013 Whistleblower Office Report are:

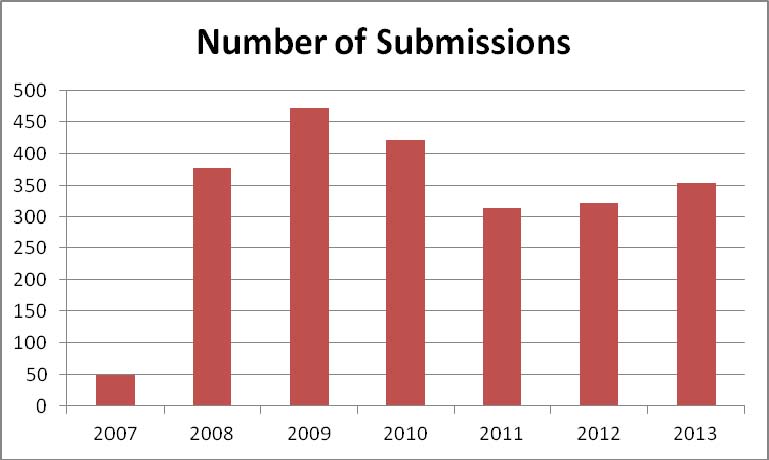

- The number of submissions in fiscal year 2013 (355) remained relatively stable from fiscal year 2012 (332).

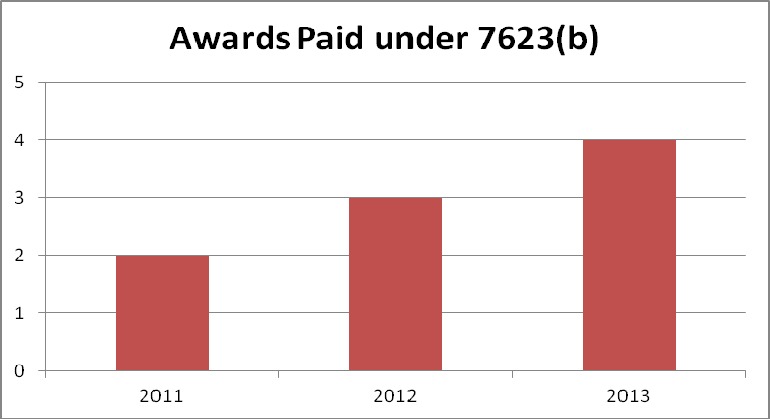

- Four awards were paid under section 7623(b) in fiscal year 2013. However, one award was $38 million, leaving $15 million to be shared among all other award recipients (including those receiving awards under 7623(a)).

- The IRS planned to finalize the proposed regulations in the second quarter of fiscal year 2014, which ended on March 31, 2014. We are expecting these to be finalized shortly.

- The IRS Whistleblower Office increased the number of senior analysts in fiscal year 2013 by three and is actively recruiting four additional staff members. This increase in staff for the Whistleblower Office is good news for the IRS Whistleblower Program because it shows that the IRS believes that by increasing the staff of the Whistleblower Office it can increase collection of tax in other operating units which are still suffering from hiring freezes.

- There has been an overall decrease in “collected proceeds” last year from $592 million in FY2012 to $367 million in FY2013. However, we are aware of much larger cases working their way through the process and those kinds of large corporate cases often take longer than that to resolve. This is consistent with what the Whistleblower Office has said many times before: it takes on average five to seven years to analyze, investigate and/or audit, and collect proceeds; and that the larger the amount at issue the greater the incentive is for the taxpayer to exercise all of their rights to challenge the IRS determinations. However, even $367,042,420 of collected proceeds is a drop in the bucket compared to the $385 billion tax gap, or the $191.7 billion of tax reserves for uncertain tax positions set aside only by the top 500 U.S. companies, which demonstrates that the IRS still needs all the help with enforcement of the law that it can get.

- The Fiscal Year 2013 Whistleblower Office Report indicates that the IRS has developed a communications plan to address outreach to both the public and IRS personnel on changes to the program. It states that the communication plan “includes efforts to identify opportunities for improvement and potential barriers to change.” Hopefully the communication plan will allow the IRS staff in the operating divisions to become more comfortable with whistleblowers in general. Additionally, this may improve the relationship between the public and the IRS and give the public an opportunity to have their concerns heard and addressed by the Whistleblower Office.

- The Fiscal Year 2013 Whistleblower Office Report outlines some areas that are likely ripe for litigation, including the definition of “collected proceeds” and amount in dispute. The report also outlines some areas that need additional guidance or legislative changes, such as providing statutory protection for whistleblowers that provide information to the IRS.

- The Fiscal Year 2013 Whistleblower Office Report states that Subject Matter Expert review is still on average 190 days. This means that more than 6 months is lost on average before the field even sees the information. Depending on the years at issue, this delay could cause the field not to open an audit due to lack of time.

One of the numbers in the Fiscal Year 2013 Whistleblower Office Report that may require some explanation is the number of claims listed with a current status of “Whistleblower Office – Case Suspended: Whistleblower Litigation Regarding Award Determination” found in Table 4 of the report. The report shows that only five 7623(b) claims are in suspended status while the whistleblower challenges their award determination in the U.S. Tax Court, but in reality more than 50 whistleblowers have sued the IRS so far. Many more than five cases are still active, and even more cases have been filed that are still under seal by the Court and will therefore be invisible until they become unsealed by the Court. We are representing whistleblowers in both sealed and unsealed cases before the Tax Court, and there are a lot of interesting things going on in discovery, but we’ll save that discussion for another day. The five cases in Table 4 are apparently those cases where the whistleblower is contesting the amount of the award, rather than contesting the denial of an award. Hopefully, the administrative review process for denied claims in the proposed regulations will be in the final version. We believe that this administrative review will save the IRS, the whistleblower, and the U.S. Tax Court time and resources by not having cases filed in the U.S. Tax Court that are dismissed once the parties exchange discovery.

Fiscal Year 2014 looks as though it will be a more productive year for the IRS Whistleblower Program. The Tax Court is preparing for what is supposed to be the first whistleblower case to determine if the whistleblower’s information should result in an award. The proposed regulations are expected to be finalized soon. These are both large milestones that will help shape the program. The IRS Whistleblower Program is taking shape and, hopefully, fiscal year 2014 will bring better news than fiscal year 2013.

Recent Comments