The IRS estimates that the gross tax gap for 2006 is $450 billion, or 17 percent of taxes. The gross tax gap is the amount of the true tax liability faced by taxpayers that is not paid on time. After its enforcement efforts, the IRS estimates that the net tax gap is $385 billion, having collected $65 billion through audits of returns for the 2006 tax year. This suggests that there are significant opportunities for whistleblowers to come forward and help close the tax gap by providing information as to which taxpayers should be audited.

Tax Gap = The amount of money per year that the IRS thinks taxpayers owe minus what they actually paid.

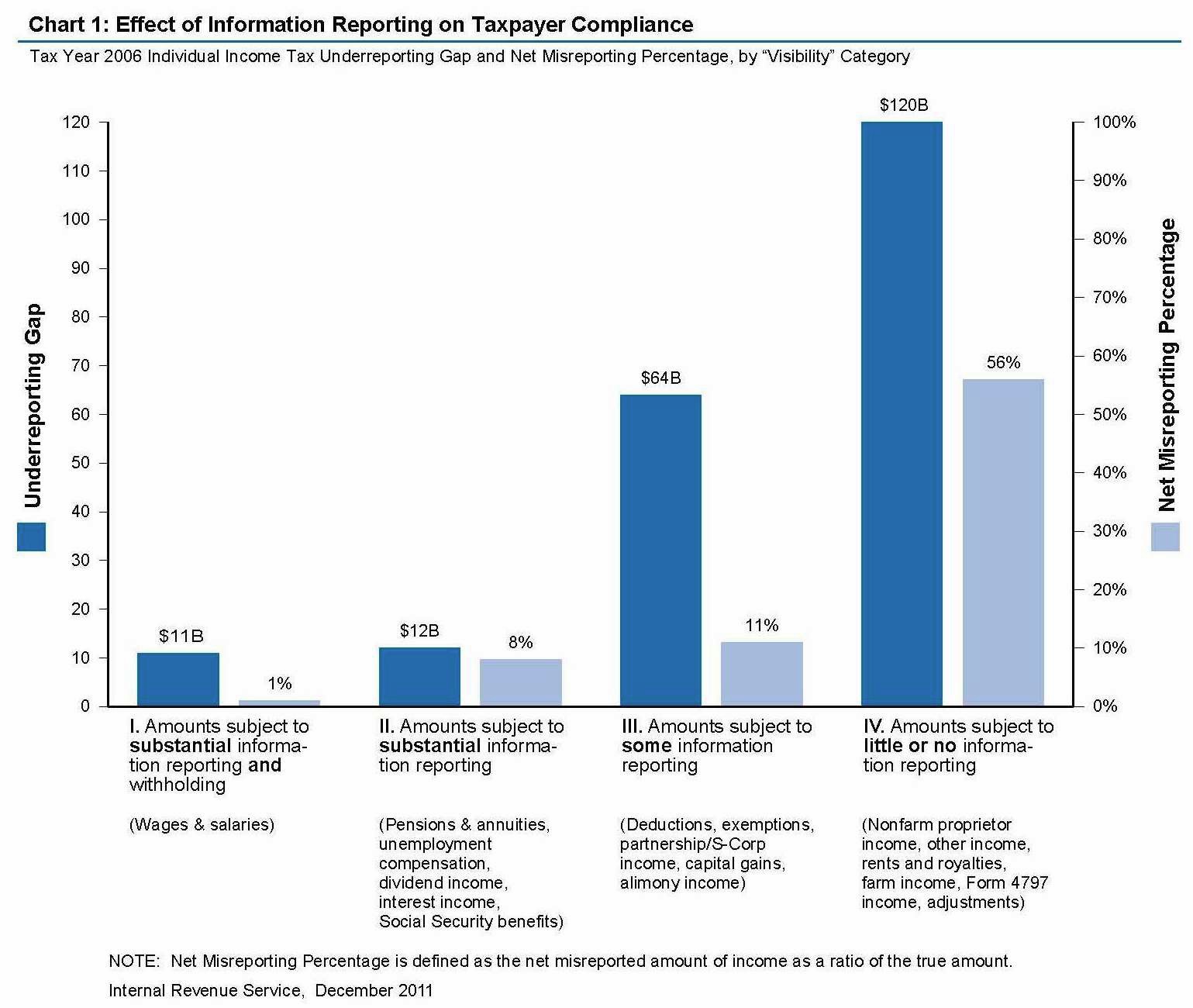

While attention has been given to the tax positions taken by large multi-national corporations and billionaires, these may not be the worst offenders when it comes to not paying their tax liability. Most of the net tax gap, 84 percent, is due to underreporting of income. Nearly one third of the net tax gap, $122 billion, is attributed to underreporting of business income by individuals. Business income reported by individuals includes income from partnerships, s corporations, and sole proprietorships. Whether the underreporting of income is intentional or not, it is relatively easy for these taxpayers to underreport their income by not including all of their receipts in income, overstating their expenses, or claiming incorrect amounts of credits due to lax reporting requirements. The IRS noted that compliance rates are highest when there is third-part reporting of income; compare the one percent of income that is not reported when subject to substantial information reporting requirements to the 56 percent of income not reported when the income is subject to little or no information reporting (see the chart below from the IRS). This suggests that the areas ripest for whistleblowers are areas with little or no information reporting.

Recent Comments