Happy New Year! The new year brings a time to reflect back on the past year, on things that went well, things that went not-so-well, and how you would like to do things going forward. In the spirit of looking back over the last year, the IRS Whistleblower Office released its FY 2017 Annual Report to Congress earlier than usual this year, right after New Year’s.

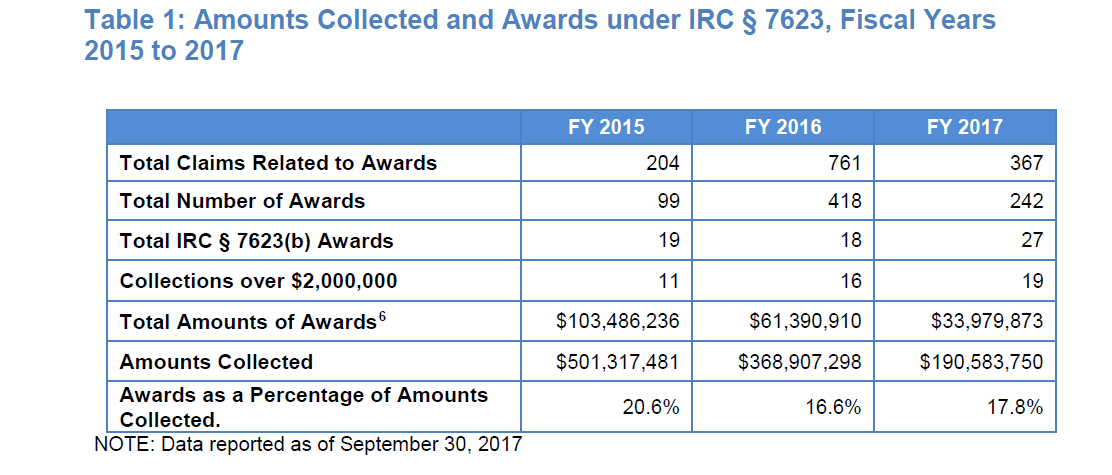

In FY 2017, the Whistleblower Office paid $33,979,873 in awards (prior to the sequestration reduction), which was less than the $61,390,910 paid in FY 2016 and the $103,486,236 paid in FY 2015. The $34 million of awards was spread across a total of 242 awards, 27 of these awards were paid under §7623(b). The total number of awards paid in FY 2017 falls between the 418 awards paid in FY 2016 and the 99 awards paid in FY 2015. The number of awards paid in FY 2016 was extraordinarily high due to a push by the Whistleblower Office to resolve a backlog of old claims that would be categorized as falling under §7623(a). Disregarding the number from FY 2016, which is largely attributable to the resolution of the backlog, the IRS Whistleblower Office has continued to grow the number of awards it pays each year. But more importantly, the number of awards paid under §7623(b) increased by 50% over the number paid in FY 2016. (The IRS Whistleblower Office paid 18 awards under §7623(b) in FY 2016, which was virtually the same as the 19 awards paid in FY 2015.)

IRS Whistleblower Program has been a success for the IRS and tax administration as shown by the fact that only 6% of claims closed in FY 2017 (down from 7% in FY 2016) were closed because the IRS audited the issue and made no change to the taxpayer’s position. That means if the IRS acts on a whistleblower’s information there is a very low probability that the IRS will not make an adjustment. This statistic should be even lower than 6% because the IRS includes adjustments that are made but were non-Title 26 Collected Proceeds – like FBAR penalties within the same statistic.

Nevertheless, the IRS Whistleblower Office should be cautious that the program does not begin to stagnate. Between the decrease in new submissions, the fact that nearly all new submissions are related to Small Business/Self-Employed Division issues, and the average time to process a claim for an award remained largely unchanged in FY 2017 from FY 2016, which was an increase from FY 2015; the IRS may have trouble making large award payments down the road if the IRS does not address some of the issues within the program and work to build additional support for the program in the operating divisions of the IRS.

The Annual Report made clear that when providing information to the IRS Whistleblower Office, whistleblowers need to ensure that their submissions are specific and credible because more than half (57%) of the claims closed in FY 2017 were closed because the Whistleblower Office found that the allegations in the claim were not specific, credible, or were speculative in nature. A knowledgeable attorney can help put together a clear and concise submission that will give the whistleblower the best chance of receiving an award.

One final note: The Ferraro Law Firm again accounted for 22% of the §7623(b) awards (by number and by value) of the awards paid by the Whistleblower Office in FY 2017. We are proud to be seeing success for our clients and happy to see the IRS recognizing the important contribution made by whistleblowers.

Recent Comments